American ingenuity has powered every “Big Tech” mega trend for the last 150 years.

From automobiles in the early 20th century … to the internet at the turn of the 21st … and now artificial intelligence (AI)…

American businesses always lead the charge when it comes to cutting-edge technology.

And early investors typically make a fortune as a result. Throw just a few thousand dollars into Microsoft, Apple or Nvidia at the right time, and you’ll find yourself counting your millions a few years later.

These are the kinds of profits investors spend their whole lives searching for.

It’s why hot tech stocks command sky-high premiums. It’s also the reason why wealthy foreign investors are piling into American tech stocks. Foreign ownership of American stocks shot up six-fold between 2002 and 2021, according to the Wharton School of Business.

But there’s still one last speed bump on the road to America’s continued AI dominance:

Semiconductors.

The High-Tech Arms Race of the 21st Century

It’s going to take massive amounts of computing power to unleash the next generation of AI. So we’re going to need more computer chips than ever before.

Right now, almost all of our best semiconductors are manufactured in the tiny island nation of Taiwan.

I won’t get into the specific geopolitical implications of that here (though they are fascinating).

But it means we’re almost wholly reliant on a foreign nation for one of our economy’s most critical resources. And that country also happens to be under increasing pressure from its neighboring China.

We all felt that dependence during the post-COVID-19 chip shortage. And the government committed to taking action…

The CHIPS and Science Act is the Biden Administration’s answer to our foolish dependence on foreign manufacturers — particularly in the semiconductor industry.

Signed into law on August 9, 2022, the CHIPS Act is providing more than $50 billion for American semiconductor research, development, manufacturing and workforce development. It further offers a tax credit of 25% for companies that invest in chipmaking equipment.

Already, a number of large tech companies are announcing plans to increase investment in the space.

Memory chipmaker Micron Technology Inc. (Nasdaq: MU) jumped on the opportunity with a pledged $40 billion investment in production capacity, which promises to increase the global market share of American-made memory chips from 2% to 10%.

Qualcomm and GlobalFoundries were also quick to form a partnership that will include a $4 billion investment in the latter’s New York facility, with projections of growing total production by 50% over five years.

And now, even Taiwan Semiconductor (NYSE: TSM) is beginning to ramp up its stateside production…

Not All Chipmakers Are Created Equal

Monday morning, executives from TSM’s Arizona subsidiary finalized an agreement to receive up to $6.6 billion in cash incentives.

They’ll also be eligible for an additional $5 billion in loans under the CHIPS Act.

If that sounds like a lot of money, consider that TSM is investing $65 billion to build three new fabrication plants in Arizona. According to Commerce Secretary Gina Raimondo, these new plants will bring “the manufacturing of the world’s most advanced chips to American soil.”

Building these new facilities will reduce the risk of another prolonged chip shortage and virtually eliminate interference or embargos from China.

That means smooth sailing for America’s rapidly growing AI industry.

But it DOESN’T mean that all chipmakers are created equal.

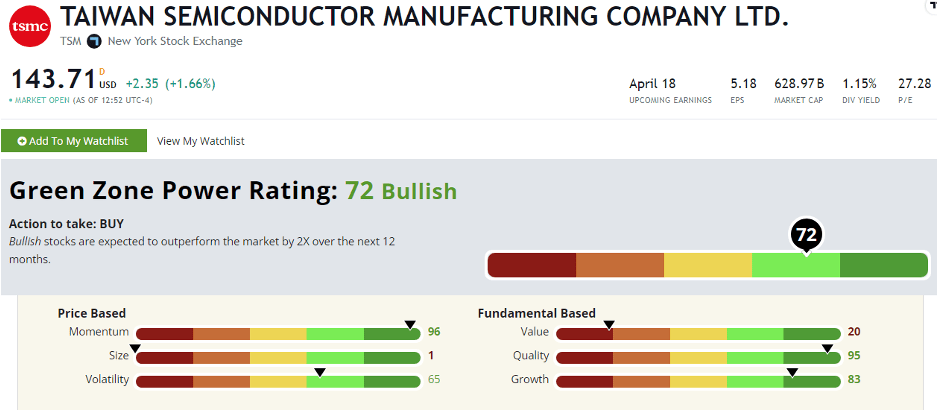

For example, take a look at the Green Zone Power Ratings for TSM:

(Click here to view TSM’s stock rating page.)

A “Bullish” 72 out of 100 is a solid rating, especially for a business that already has a near-monopoly in its industry. There’s clearly plenty of room for TSM to keep growing if management can keep things on track.

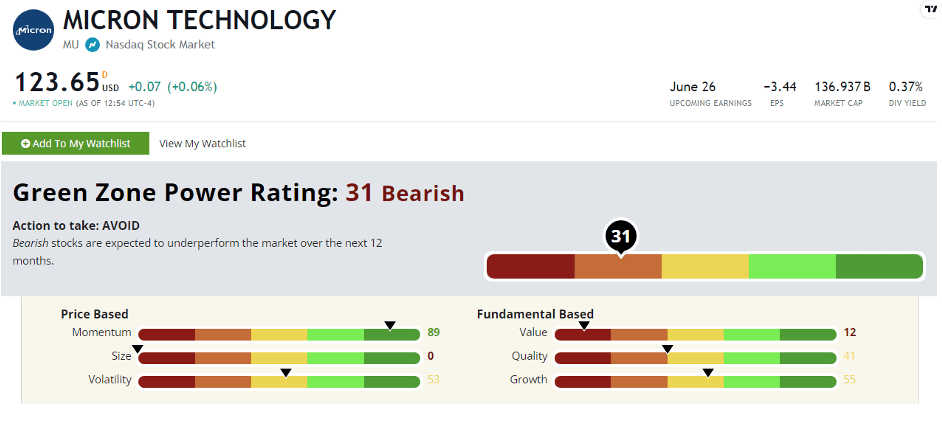

Meanwhile, here’s how MU rates:

(Click here to view MU’s stock rating page.)

31 out of 100, with negative earnings per share. Each stock’s Green Zone Power Ratings are based on a combination of fundamental and technical factors. And as you can see above, MU is a bad investment on both fronts.

Even with billions in government aid pouring into the company, shares are still likely to underperform over the next 12 months.

That’s why I recommend checking Green Zone Power Ratings early and often when you’re thinking about investing, if you’ve already invested — or you just read about a stock in a news story.

Because two companies like these are often mentioned in the same breath on CNBC or in the Wall Street Journal … even though they’re vastly different investments.

The race for semiconductor dominance is going to be a dominant mega trend in these early stages of the global AI boom. And that’s great news if you’re invested in the right chipmakers.

Stay tuned for more updates as this trend develops.

(For more on the market’s top AI investment — a company that the world’s top Tech Titan has labeled “the Next Google” — check out my special feature presentation HERE. I strongly recommend taking action on this opportunity BEFORE May 5.)

To good profits,

Chief Investment Strategist, Money & Markets